Our Investment Products

Ascot Wealth Platform provides access to a variety of products giving the benefit of being able to invest in over 3,000 investment choices including; Funds, Shares, Exchange Traded Funds, Investment Trusts and Discretionary Fund Managers. This wide ranging investment universe gives you the ability to create highly tailored investment strategies for your clients.

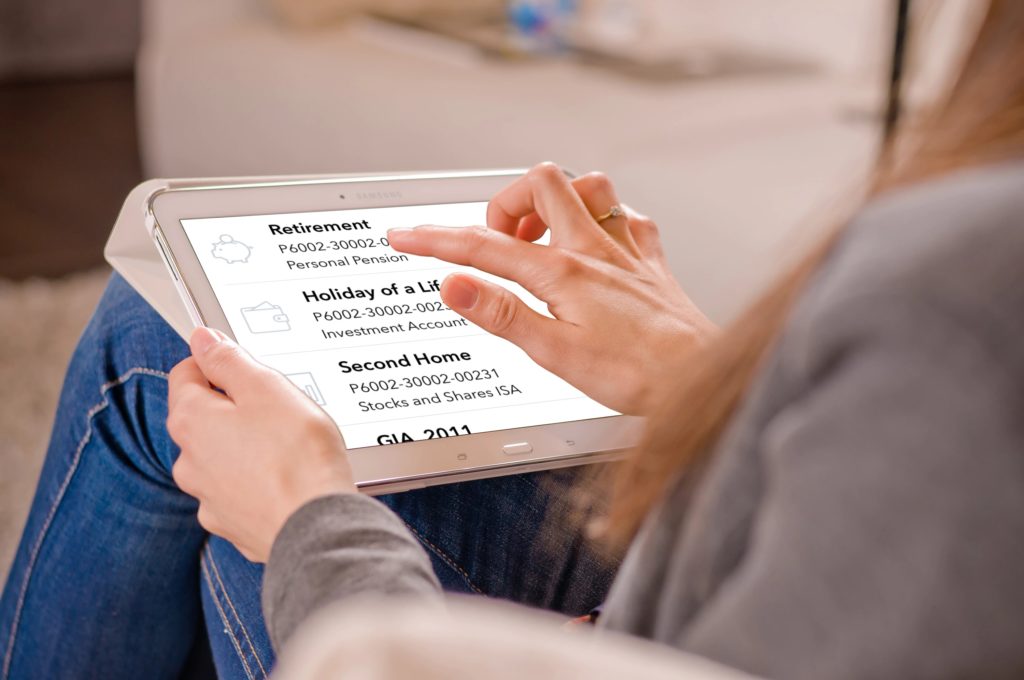

We can then help you and your clients to manage their account through our online and mobile app platforms.

The following products are available on Ascot Wealth Platform:

- Junior ISA

- SIPP

- Stocks & Shares ISA

- General Investment account

- Offshore Bonds

- Onshore Bonds